are car loan interest payments tax deductible

However there are exceptions to that rule ie a business owner who takes out a personal loan to invest in the enterprise. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

Solved Where To Enter Car Loan Interest

Interest on vehicle loans is not deductible in and of itself.

. For more information see Publication 535 Business Expenses. According to HR Block interest is non-deductible when the. In most cases your car loan interest is not tax deductible.

In addition loan interest is one of the few expenses you can deduct in addition to the standard mileage deduction the others are registration fees tolls and parking charges. If you are an employee of someone elses business you are not eligible to claim this deduction. Interest paid on personal loans car loans and credit cards is generally not tax deductible.

Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil repairs and servicing lease payments insurance premiums registration and depreciation. You can deduct the interest paid on an auto loan as a business expense using one of two methods. The first question you need to answer is whether or not you are self-employed.

The answer to is car loan interest tax deductible is normally no. Therefore the quick and easy answer to the question is no However some other loan-related expenses are deductible so dont stop at auto loans when searching for deductions. If you use your car for business purposes you may be able to deduct actual vehicle expenses.

During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer be tax deductible. Interest is an amount you pay for the use of borrowed money. Payments made online may take up to 48 hours to post to your account.

This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction. For tax purposes a van is within the category of plant or machinery. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

If your van has zero emissions you would once have been able to claim a van benefit exemption. But you can deduct these costs from your income tax if its a business car. Late fees and additional interest may apply.

Up until 1986 it was possible for auto loan interest to be tax deductible. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Payment over 100000 may be rejected.

Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. When claiming deductions of any kind on your tax returns it is best to keep detailed records and supporting. However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against your self-employment income.

In addition interest paid on a loan thats used to purchase a car solely for persona. For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

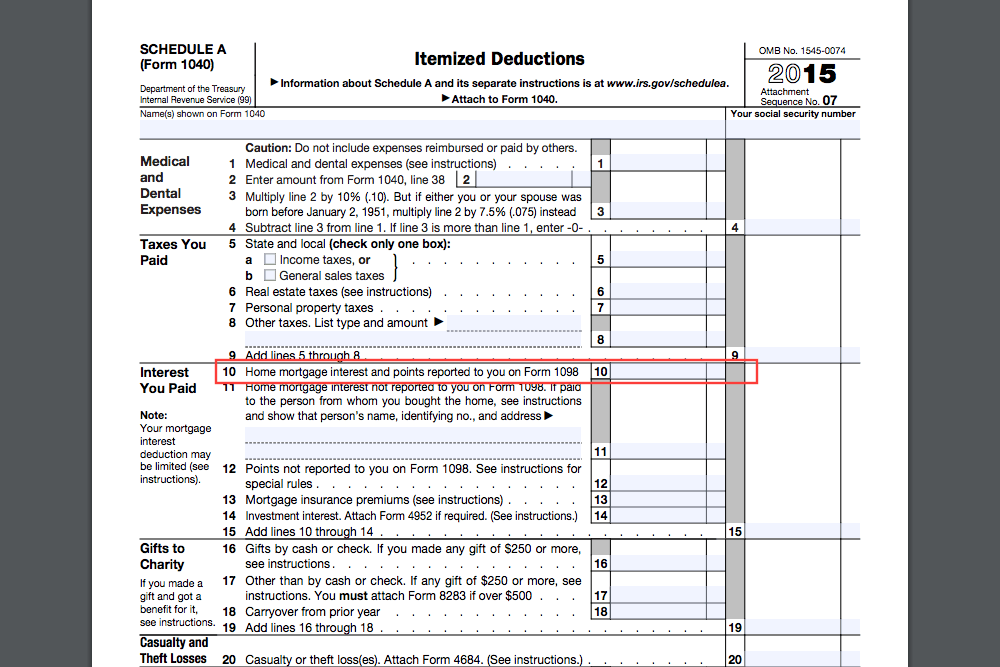

Interest Payment Deductions The cost of a vehicle is not a deductible expense but the IRS does allow you to write off any interest payments made on a loan for the purchase. If the car is used for a schedule C self-employment business there are two ways of deducting your vehicle expenses one of which would include the interest proportional to your actual business use of the car. For example if your car use is 60 business and 40 personal youd only be able to deduct 60 of your auto loan interest.

But there is one exception to this rule. Can I use my car loan payments as a deduction. Some interest can be claimed as a deduction or as a credit.

To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. You might pay at least one type of interest thats tax-deductible.

Interest on car loans may be deductible if you use the car to help you earn income. The same rule applies to car loans. But you cant just subtract this interest from your earnings and pay tax on the remaining amount.

The faster you pay off your car title loan the less you will pay in interest. If you do use your vehicle for business a. If you use a van regularly for your private use you can claim assessable van benefit which is currently 3350.

Typically deducting car loan interest is not allowed. Late payments may be subject to a late fee per the contract you signed. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax.

On a chattel mortgage like. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes. If on the other hand the car is used entirely for business purposes then the full amount of interest can be written off.

Read on for details on how to deduct car loan interest on your tax return. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage. As a general matter personal loans do not carry deductible interest whether they are installment loans or lines of credit.

If you are not then you will not be able to claim any tax relief on car loan payments. More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of factors. You can also claim fuel benefits for costs up to 633.

The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car loan tax deduction. The expense method or the standard mileage deduction when you file your taxes. The interest on a car title loan is not generally tax deductible.

Interest on a personal loan other than a home mortgage is never deductible. You would also have to claim actual vehicle expenses rather than the standard mileage rate for your vehicle expenses. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

The costs you can deduct with the actual expenses method include gas repairs insurance oil changes. You must report your tax-deductible interest to the IRS and this invariably.

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Car Loan Tax Benefits And How To Claim It Icici Bank

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Car Loans For Teens What You Need To Know Credit Karma

Can I Do A Tax Write Off For A Fully Paid Car When Using It To Advertise In 2022 Business Structure Business Owner Sole Proprietorship

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Is Buying A Car Tax Deductible In 2022

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Tenure Us Home Loans Loan Calculator Loan

.jpg)

How A Self Employed Can Apply For A Car Loan Axis Bank

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

Are There Car Loan Interest Tax Deductions Tips From A Maryland Toyota Dealer Maryland Toyota Dealer

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Can I Write Off My Car Payment

Automobile Loan Payment Calculator With Amortization Schedule Amortization Schedule Paying Off Mortgage Faster Car Finance

Car Loan Tax Benefits On Car Loan How To Claim Youtube

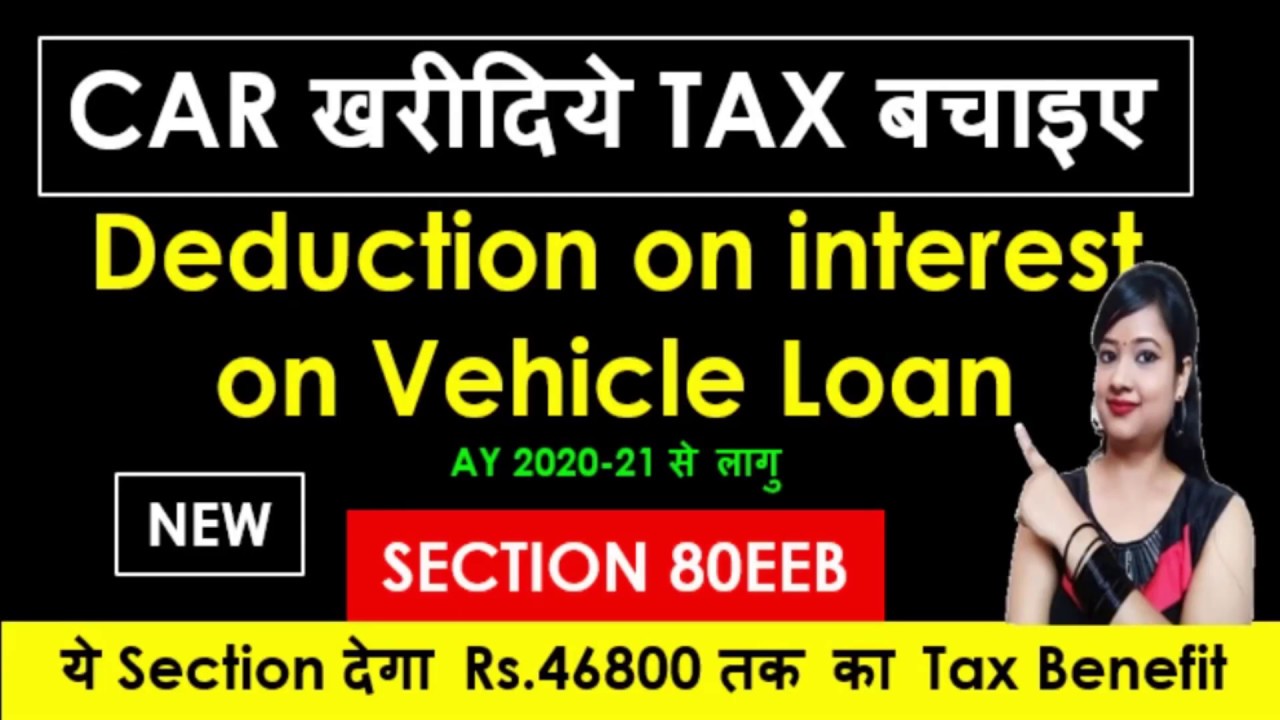

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

How To Secure A Low Rate Car Loan Car Loans Car Finance Financial Tips